Evidence in the face of belief

Chris already has a halo

Chris, Mum and I were talking about the saintly behaviour by some under lockdown (not referring to any of ourselves). All of us have our quirks, but in some cases it appears that people might truly deserve canonisation for remaining calm and cheerful in the face of their bubbles. Canonisation is the interesting process through which people are pronounced saints. It is important to note that people are not ‘made into’ saints, but the process recognises their inherent saintliness, which has been expressed during their lives.

We investigated the steps of the canonisation process in relation to Mother Teresa as a recent and famous saint. Pope John Paul II was responsible for her canonisation, and changed the process to get permission to start canonisation only 2 years after her death. Normally there is an enforced wait of 5 years to aid objective evaluation of a candidate. It is interesting how much the processes have changed through time – originally canonisation simply required approval of the local bishop, but the process is now extremely long and bureaucratic. John Paul II canonised 482 saints during his 26 year reign as Pope. Perhaps he was a really good bureaucrat, or else very interested in saintliness.

Once the canonisation process starts a major investigation is undertaken. In the case of Mother Teresa, Father Brian Kolodiejchuk was appointed to gather the evidence and submitted 76 documents, totalling 35,000 pages, based on interviews with 113 witnesses who each answered 263 questions. Sufficient evidence of her Heroic Virtues were gathered for the Pope to approve her as “Venerable”. The next step is ‘beatification’, which requires a documented miracle attributed to the ‘Venerable Servant’, that cannot be explained scientifically after a thorough investigation by the diocese in which the miracle allegedly occurred. This miracle must have occurred after the death of the ‘Venerable Servant’.

Mother Teresa was considered to have miraculously cured a woman in India of cancer, through application of a locket containing Mother Teresa’s picture to the woman’s abdomen. The investigation that ‘proved’ this miracle, managed to ignore the evidence of Dr Ranjan Mustafi, a gynaecologist who treated Ms Besra. He stated that his patient did not have a tumour, rather a cyst caused by tuberculosis that disappeared after she took appropriate medication. Supposedly her husband has confirmed this. Subsequently, none of the medical doctors who certified that the healing was scientifically inexplicable could be found. However, this occurrence was deemed a miracle and resulted in Mother Teresa’s beatification. A second miracle was also identified, required to complete the process. As a result, Mother Teresa was elevated to sainthood on September 4 2016.

In the case of the first miracle, it appears that there was strong evidence that the cure was courtesy of medical treatment, however there was extreme determination to regard this event as a miracle to step forward the canonisation process. Much time and effort had been expended in establishing Mother Teresa as a saint; as importantly, many already believed she was a saint. Evidence quailed, and was overrun, in the face of strong belief.

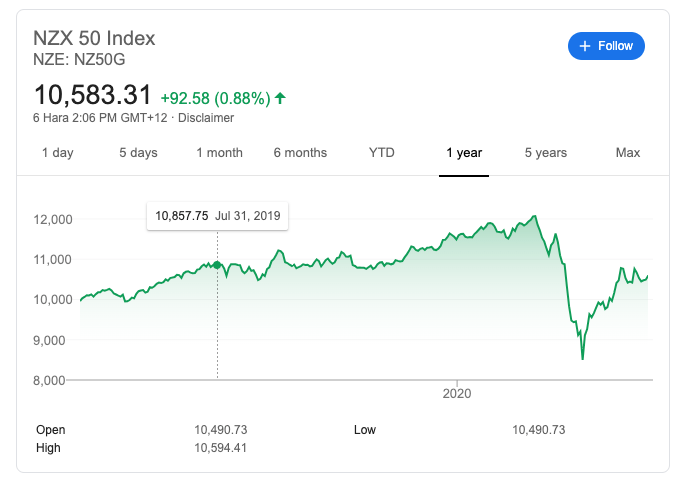

Such challenges to evidence are frequently evident, including in our COVID-19 era. The behaviour of stock exchanges seems totally counter-intuitive. They initially slumped as the pandemic became apparent worldwide late March, then rallied.

How does this work? We are told that our economy is being destroyed by the lockdown, but the share markets rally? Equally surprising, Auckland airport undertook an extremely successful capital raising process to shore up its finances given the almost complete lack of flights at present and the gloomy flying future in 2020. This process was oversubscribed, and shares leapt up following the capital raise. So people think that Auckland airport is going to do well? Without revenue from flights, or people buying things in the airport? Warren Buffett, a famed and successful US investor known for his long term vision has recently sold his Berkshire Hathaway’s roughly 10% stakes in American, Delta, United and Southwest stating that “the world has changed for airlines”. Perhaps NZ equity purchasers know more than he does.

However, it is also quite possible that NZ investors don’t know more than Warren Buffett, they just want to believe something entirely different. Market logic is, apparently, that previous falls ‘priced in’ the consequences of the coronavirus crisis and that investors are now ‘buying the recovery’. To trust this thesis, one needs to believe in a recovery! There appears to be belief, more than evidence, that there will be a ‘V-shaped’ economic recovery, coming to your place soon. The International Monetary Fund believes in this – it predicts that world economic output will fall by 3% in 2020 but then grow by 5.8% in 2021 i.e. worldwide GDP will be higher in 2021 than in was in 2019.

The airline industry has been a bellwether for business prospects, with a general expectation prior to COVID-19 that the industry would continue to grow at about 3% p.a., increasing 90% in total by 2040. Airlines are particularly relevant to New Zealand, given our economy’s dependence on tourism. Here are some projected scenarios for the industry provided by a consultancy, with the dotted line being the pre-COVID-19 projections.

Economic scenarios get labelled with letters. This has its limitations – there are some shapes that don’t fit any letters! The highest likelihood scenario above is called a ‘prolonged U’, I have also heard it called a ‘Nike swoosh’, which might sound more positive than ‘eeeeeeeewwww’. The projections incorporate the obvious barriers and challenges for the industry, such as:

- Physical distancing in airplanes that will be required until there is a vaccine (and if not required, demanded by customers). Therefore we can only fly half the number of people in the existing fleet of planes.

- The cost of flying will need to rise to cover the greater spacing of people.

- How many airline businesses will collapse in the meantime (and how many are propped up by governments), determining how many remain to service any need and what their financial requirements are i.e. the cost of flying.

- Any increased cost will need to be paid by people who may have lost jobs or had reduced pay as a result of the economic downturn.

- A worldwide vaccine is at least 12 months away, and could be 24 months, or never, which will limit which countries people can travel to as some countries will have highly controlled borders e.g. New Zealand.

- Fear will remain that travellers could be trapped overseas if a new lockdown is implemented; it is also likely that people will take on financial risk to travel because insurance won’t cover pandemics.

The conclusion would have to be that a V-shaped recovery back to previous growth projections doesn’t look very likely. However, as evidenced by the Auckland airport equity raise, many people still believe in a V-shaped recovery, because the alternative isn’t palatable. Alternative scenarios can look like a decrease, or ‘degrowth, and degrowth not an economic concept anyone is accustomed to accepting. The economic mantra has been, and remains, ‘growth’ and if we lose belief in a V-shaped recovery, we lose our belief in growth.

What will change our belief in the V-shaped recovery, and lead to an acceptance that growth may not be inevitable? If Donald Trump is anything to go by, it isn’t a plethora of evidence on its own that will change people’s minds, because the evidence that Trump is not a sound leader is abundant, but he is more popular than ever.

What actually changes people’s minds? Two of the most influential things are what people believe others to think, and time. This raises the importance of media, and social media, particularly in a time of lockdown. If the messages we read, hear and watch over time continue to tell us that this is a time of change, we may believe in change. If social media posts tell us that other people see the possibilities of a Nike economic swoosh, and that it isn’t such a bad thing, we may jointly come to that conclusion. And, if those of us who believe in change allow others to take their time, we may all shift in a way that still barely seems possible, but just might be.

Whose is the propaganda here?