Money machines

I found this picture from Wellington, in 1981. So many classic things - the haircuts, the clothes, the signs. I remember the excitement at the time of being able to get money from a machine, rather than a bank teller, which seemed quite magical. However, no more magical that the way that governments seem to be magicking money out of thin air right now!

There is no doubt that New Zealand, and all countries, are going to increase the amount of public debt they hold because governments are borrowing heavily to pay money to those who are not earning, or whose businesses cannot function, during lockdown to slow the spread of COVID-19. Debt has always seemed to me to be the antithesis of freedom. If you are locked into a debt, your set of choices is limited by the extent to which you have to earn money to repay that debt. Obviously one needs to eat and have a roof over one’s head as well, both of which require some degree of income. However, it is possible to minimise the costs of both for yourself, through choosing where you live and how much of your own food you can grow/acquire, but repayment of debt is controlled by someone else.

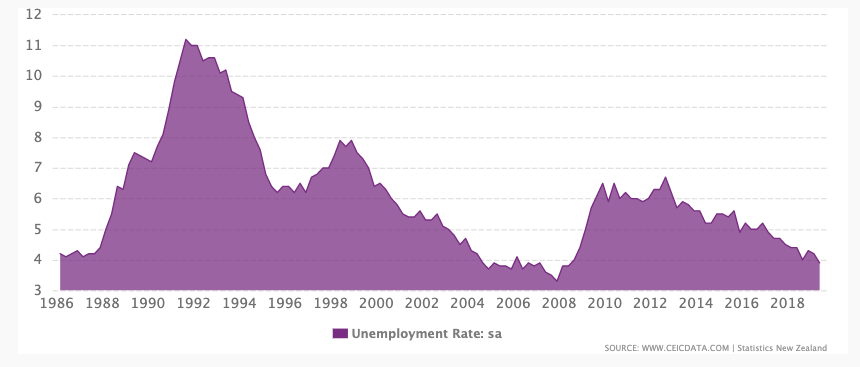

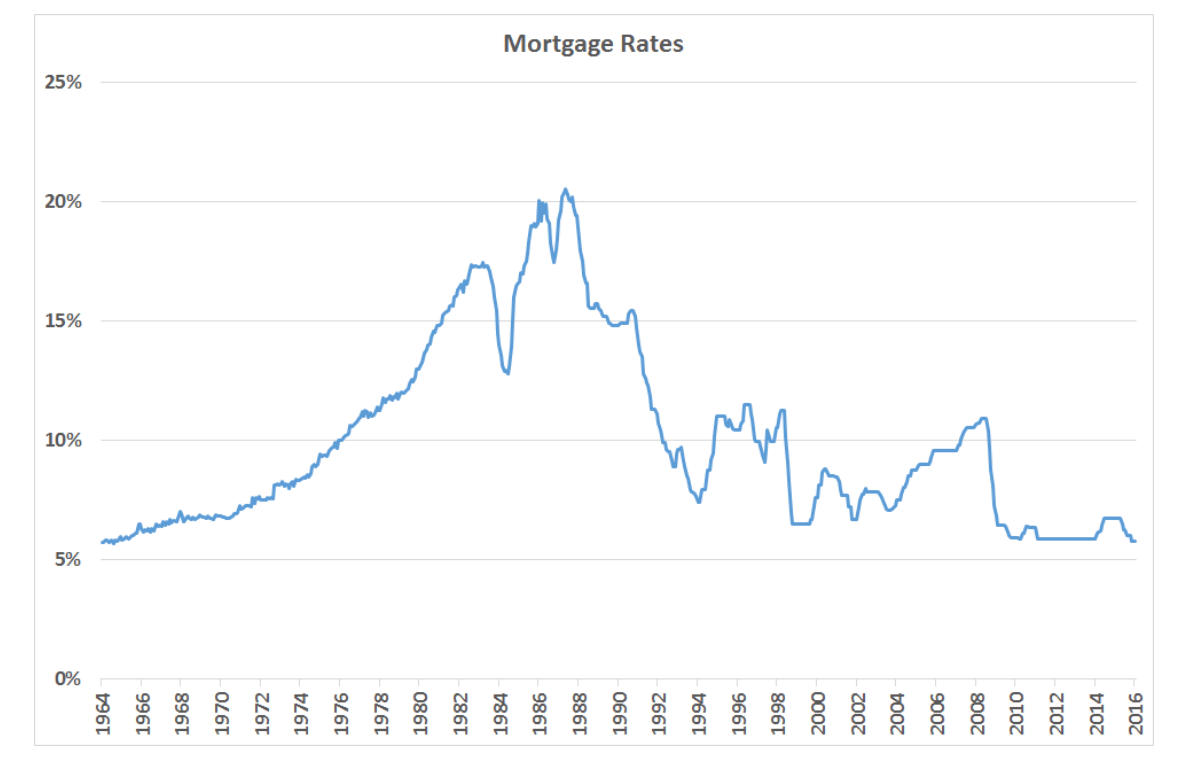

My debt phobia almost certainly developed in the 1980s, when roaring inflation meant that people were paying mortgage rates up to 22% and some were walking out of houses because it was the cheaper option. Unemployment went up to 11% by 1992 (see below), related to the massive structural changes the country was undergoing. That sort of rate of unemployment, which the post pandemic era may well exceed, made one aware of the privilege of having a job. I believe growing up in a time of financial difficulties is a good thing because it makes you careful in regard to money for the rest of your life. The chances are that there is going to be at least one difficult patch in your economic life, best have it early (which also gives you time to recover from it)! I don’t envy people who came to their financial awareness in the early 1990s or later in New Zealand, because they have never seen extremely bad financial times, nor times of mass unemployment – the GFC was a relatively small blip on New Zealand’s financial and employment radar.

New Zealand unemployment rate from 1986 to 2020

I have lived for a long time ignoring the contradiction between my internal certainty in regard to minimising personal debt and the advice that to create lots of wealth, the best way to do it is to borrow. That advice becomes even louder when interest rates are low, with the apparent cost and risk of borrowing money being relatively minimal.

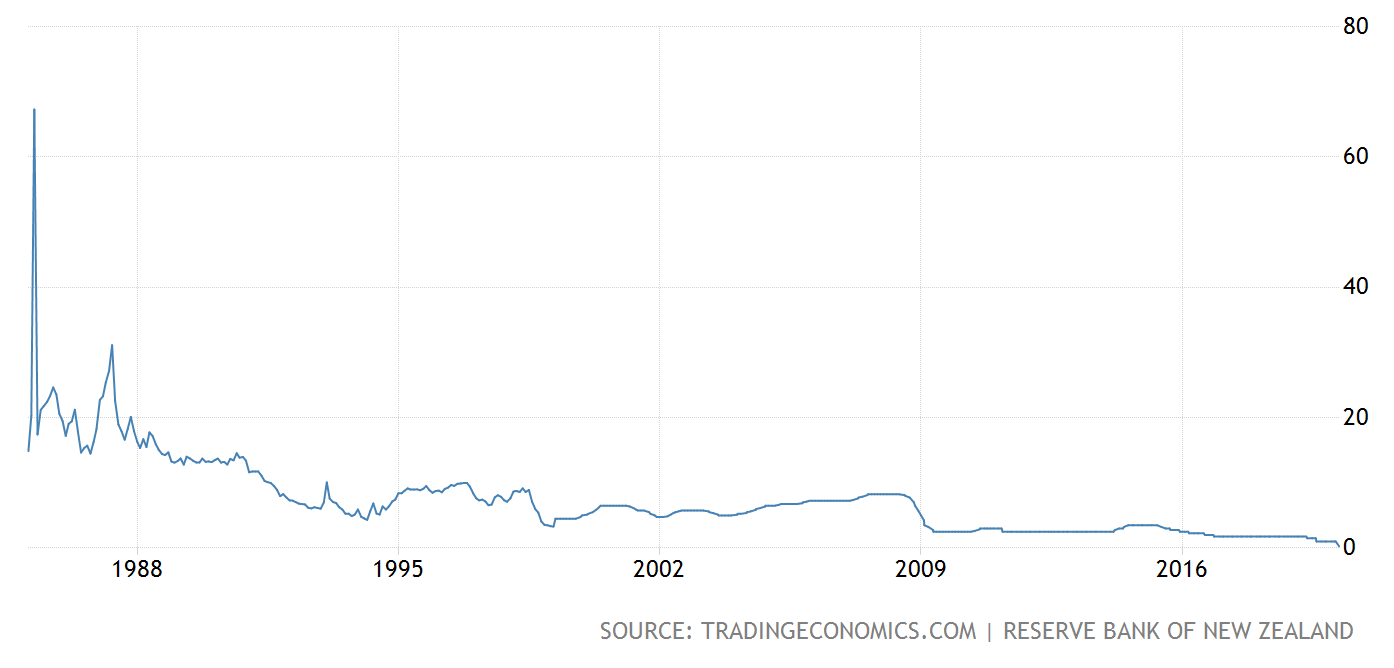

New Zealand Reserve Bank cash rate 1986 to 2020

New Zealand home mortgage rates 1964 to 2016 - they have tracked down since to around 4%

When lots of shit (or COVID-19) hits the fan, the borrowing advice starts to sound hollow as people try to figure out how to service their debts in the face of unemployment or reduced wages. The advice was a good thing if you managed to become rich in the meantime, but if you didn’t, you might be feeling quite poorly. However, this is the time when governments have no choice other than to rack up enormous debts on behalf of their citizens, which they tell us we will be paying off for decades to come. This makes me exceptionally nervous (not just because of my debt phobia) because I wonder how this will set us up for the next crisis, which might well be a lot sooner than decades away. Christchurch didn’t even manage a decade between crises! As for the world, the climate change thundercloud is not moving away from us.

Notwithstanding my concerns, our government needs to stop businesses collapsing unnecessarily rapidly, and stop people going hungry and cold in the short term as their work is unavailable but they still have bills to pay. Not to mention, we are apparently going to need to incur a whole lot more debt to stimulate the economy once lockdowns end – money needs to be pumped into our financial systems because movement of money is what keeps economies alive. The nature of the projects that money should be spent on is another huge topic of conversation which, thankfully, the Greens are keeping a close eye on, because if there is anything we should spend on, it is averting climate change threat.

The New Zealand government was reported on 1 April to be borrowing $25B , around 1/8 of our 2019 GDP. Across the world, the IMF reckons gross government debt will rise by 10% of the current total, to $66 trillion by the end of 2020. One almost feels like, what does it matter? If the world could manage $60 trillion in debt, which seems like a ridiculous figure, what’s another $6 trillion more? If we own our national debt, we just owe money to ourselves which doesn’t seem very terrifying at all. Another odd side of the scale of government borrowing is that people start to feel like the government can afford anything the people want – how come we couldn’t borrow this money ages ago and have all the things like a decent healthcare system that we are now needing? A simple answer is that we probably could have already, if we can now!

Our Reserve Bank is not ‘printing money’, but creating electronic money with which it buys government IOUs, otherwise known as ‘bonds’ or ‘securities. The Reserve Bank is in effect buying the securities handed over by the Government which satisfy entities who are providing us with their savings – there are still plenty of savings sloshing around the world. “The government issues the bonds to the market at the current market rate, and then the Reserve bank buys them from the market,” as explained by The Economist. The more money it creates, the more the Reserve Bank can buy. Banks take the new money and buy assets to replace the ones they have sold to the central bank. That raises stock prices and lowers interest rates, which in turn boosts investment. How long can this go on? There is some point at which there is an insufficiency of investors and those investors demand higher interest rates, apparently those in the NZ financial know consider this point to be a considerable way off.

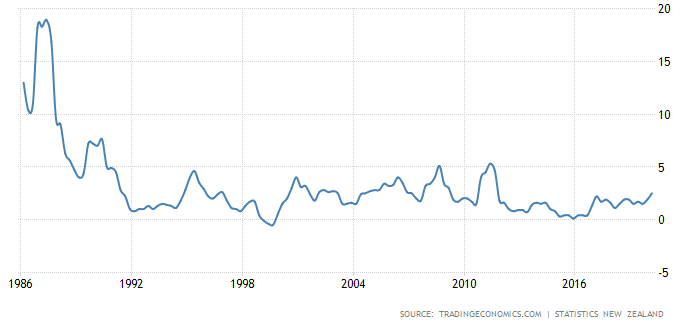

If too much money is created, in the end there will be too much money chasing too few things to buy, which means that inflation will rise. New Zealand’s monetary policy, intended to sustain employment and achieve price stability, targets an inflation rate of 1-3%. This is achieved by altering the Reserve Bank cash rate, which is now at an all time low (in the graph two above). This could be a good thing – we can decrease our effective debt through inflation. However inflation also tends to reduce employment and make everything too expensive for people to buy (I remember that from the 1980s). If we need to decrease inflation, because things are getting too expensive for people, the Reserve Bank would need to raise interest rates and then our debt would cost more to service. Apart from sounding complex, there is a fundamental aspect to these principles that worries me immensely. Economists rely on ‘laws’, regarding how things work in economies. These are not like the laws of physics, or mathematics – they are definitely not immutable, but are empirically proven, or sometimes not proven at all! Our monetary policy of managing inflation by changing the cash rate has long relied on a law that says if interest rates decrease, inflation increases. Except for the last little while it hasn’t (see this graph and the ones above). At this point I lose a lot of faith in the principles of economics and wonder if hope is our only resort!

New Zealand inflation rates 1986 to 2016

In the end, the likely answer is that we have no choice in our country incurring debt. Without more money being pumped in, businesses will collapse, those businesses won’t employ people, our government won’t be able to employ any extra people, and the unemployed people will all get hungry and unhappy which leads to a whole lot of worse potential outcomes. This leaves me feeling that the answer is to have faith in low interest rates – because if they are what everyone wants then everyone will collude to make them happen and, in the end, they are figments of our collective imaginations! If this is the case, perhaps we should be testing the economic system even further by borrowing to create human ecosystems which deal to the issues driving climate change, because the threat of economic collapse seems a good deal less certain and more tractable to our wishes than our planetary environment is likely to be if we continue on with our past trends [The definition of insanity is doing the same thing over and over again and expecting a different result – Misattributed to Einstein].

Hands up those who would rather not currently be in the USA (with apologies to those who currently are)