Inflation & interest rates

It was time to pull out my crystal ball to contemplate the future of interest rates and inflation in New Zealand. I actually pulled it out a few times in the last 2 months, and meant to document my prediction of interest rate rises by the end of the year, but more other interesting things to blog about took precedence. Honest, I really did predict them, because the necessity of such rises has been dead obvious – no crystal ball required. My prediction was that the country would hit a sticky patch by the end of 2021 in regard to rapidly rising inflation and the associated need to raise interest rates to curb inflation.

In New Zealand inflation control is in the under remit of the Reserve Bank and is wholly owned by the government. The Reserve Bank has three main roles:

- formulate and implement monetary policy to maintain price stability and support maximum sustainable employment;

- promote the maintenance of a sound and efficient financial system; and

- meet the currency needs of the public.

The New Zealand monetary policy framework has a goal of price stability (like many other countries). Government defines the monetary policy targets, and requires the Reserve Bank to keep inflation (as measured by the Consumer Price Index (CPI)) between 1% and 3% on average over the medium term, while supporting maximum sustainable employment.

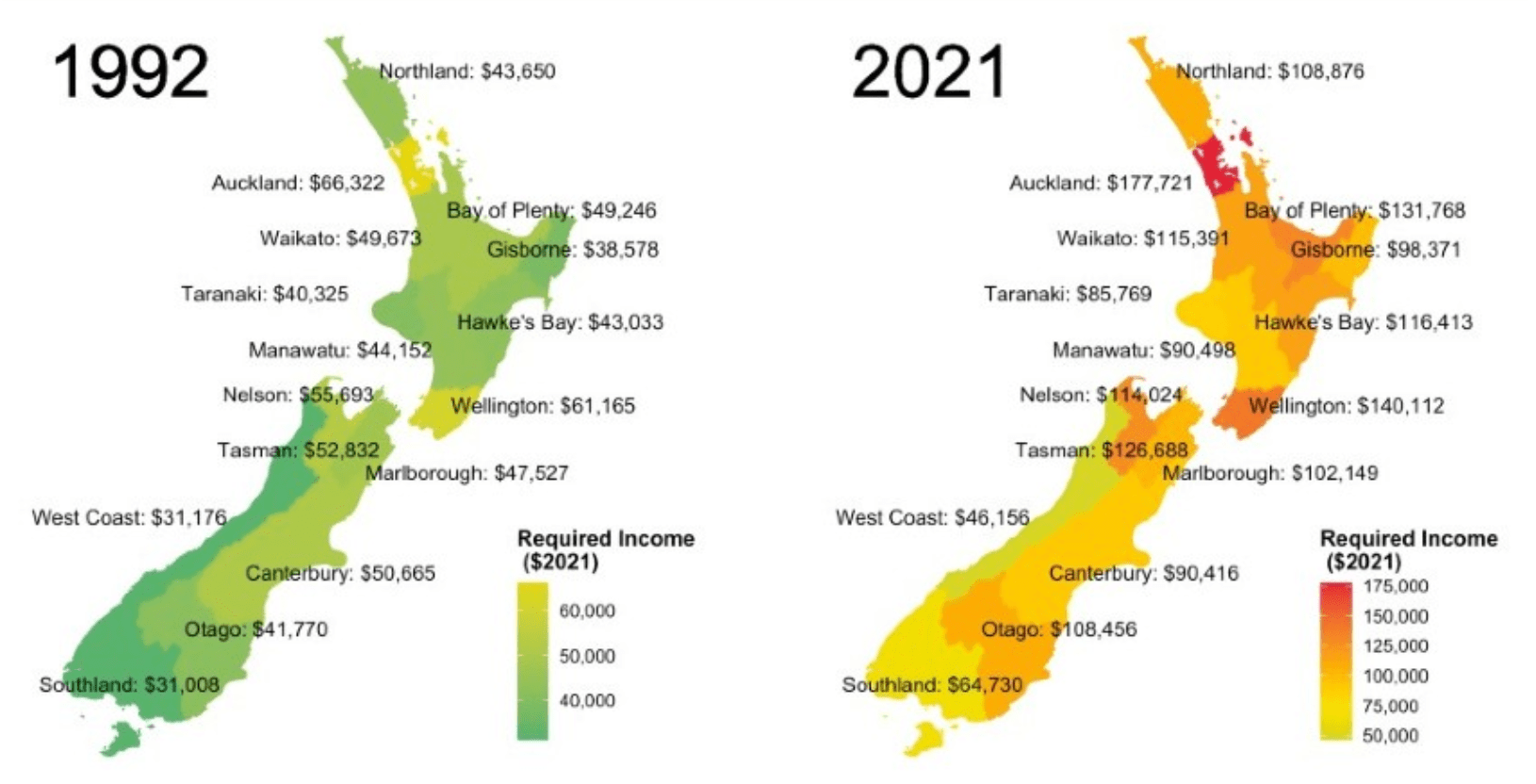

In February 2021, the government also added in that the Reserve Bank must consider the impact of its decisions on house prices. This goal got added as the government searched for ways to manage New Zealand’s massive inflation in house prices post COVID lockdown. For anyone still thinking that “it has always been hard to buy a house in New Zealand”, ( which is how some reacted to my blog on house prices in June ) here is a link to a good SpinOff article showing just how much harder it is today compared with 1992. The reason that house prices had to be specifically added into the remit of the Reserve Bank is that the CPI, which the Bank is required to manage, does not include house prices. In 2016 Shamubeel Eaqub was pointing out this omission , based on the CPI being a reflection of goods and services. He said, this differentiation may be useful to statisticians but means the CPI does not reflect the inflationary pressures on actual New Zealanders.

The Reserve Bank doesn’t have a lot of tools at its disposal to control inflation. In fact, it basically has a single tool – the Official Cash Rate (OCR). The OCR is the rate that the central bank charges merchant banks when they borrow money. Those merchant banks lend money to people and businesses, and the interest rate at which they lend is affected by the interest rate charged on the money they are borrowing from the central bank. In other words, as the OCR rises, interest rates rise on loans, including on mortgages.

When inflation rises, the Reserve Bank raises the OCR to reduce inflation. The rationale here is that borrowers tend to reduce their spending as the cost of borrowing money rises increases, and savers have an incentive to save more money, because their interest returns are higher. These effects both lead to less spending in the economy reducing inflationary pressures.

Since the start of the COVID lockdown in 2020, the opposite phenomenon has been in place – the Reserve Bank has been reducing the OCR to stimulate the economy, given significant fears that COVID would result in a recession (a decline in production of goods and services). At the same time as the Reserve Bank has been reducing the OCR to grow the economy, the government has been creating new money through quantitative easing (QE). In other words, lots of money has been pumped into our economy. There is a basic economic principle that says when you have a lot of something people value it less. So if you add a whole lot of money into the economy, the basic principle is that the money is worth less i.e. it can buy less, which means you end up with inflation. In 2020, the Reserve Bank warned the government that QE would lead to house price inflation, but Grant Robertson didn’t believe them. However, at the same time the Reserve Bank was forecasting negative interest rates, which they then quietly backed away from with not a whisper as to their former thinking, so perhaps the Reserve Bank is not 100% believable.

In 2020 it truly seemed like the government was engaging in magical thinking – if we don’t believe in inflation it won’t happen. Disturbingly, this does have a basis in truth. One of the significant causes of price inflation is people believing prices will inflate. The main causes of inflation are:

- an increase in the supply of money – NZ did that with QE;

- when there is more demand for goods and services than can be supplied – NZ has labour shortages related to lack of immigration, NZ has goods shortages related to failure of transport systems around the globe and use being in the bottom corner, NZ has a whole lot of people with money and nowhere to spend it (including money from their massively increased house values as well as QE);

- cost push inflation where increased costs of goods raise prices – increased cost of goods from offshore mean this is happening too;

- built-in inflation – where people expect prices to inflate into the future so demand more wages, which increases costs, which increases inflation… – we are starting to see strikes associated with wage demands in NZ e.g. nurses striking for 17% salary increases.

So, New Zealand has all the factors in place to ramp up inflation and the government didn’t manage to convince the populace to join in the magical thinking long term. We have had house price hyperinflation 2020-2021, but that wasn’t counted in the CPI, so the Reserve Bank didn’t have to act. However, this quarter the CPI rose by 3.3%, the biggest rise in a decade. Shock, horror, how could that have happened? Grant Robertson says “This is an “unexpected development” from where the country was a year ago”. Unexpected? The government clearly has been keeping their crystal balls (and their brains?) in a cupboard for the last year!

I have also heard commentators say that the NZ government (and governments internationally) will keep a lid on interest rate rises to keep a lid on the cost of their substantial debts, resulting from QE. This will be tricky – the government would have to change the Reserve Bank’s instructions substantially, because currently the Reserve Bank’s job is to control inflation and their only tool is interest rates.

The reaction of the Reserve Bank to the “unexpected” inflation has been to forecast interest rate rises; four of them likely to happen by early 2022, raising the OCR from its current all time low of 0.25% to 1.25%. The government and the Reserve Bank are leaping to reassure the population – interest rates will rise, but only a little bit. So, in 2020 we were told negative interest rates were likely. Early 2021, economic commentary predicted interest rates would rise in 2022 but not in 2021, possibly not till 2024. Now, in the second half of, 2021, OCR rises are happening soon. But interest rate rises won’t be too big, and they won’t take mortgage rates above 5%. Anyone out there believing these predictions? Not this fortune teller!